1st time 1099

One ramification of the rise of the sharing and on-demand economies is how many people will be receiving IRS form 1099 for the first time.

feels like the first time

Dear Travis, Apoorva, Leah, & all of collaborative economy CEO’s —

Congrats on the growth last year, and all the new people you’ve brought into the mobile, fractional workforce who have earned income in your marketplaces and platforms. You’ve enabled a new sector of the workforce to go independent.

There are 180+ of you now. In fact, while you read this article, someone is no doubt launching a new Uber for X category. That also means that right now, there are tens of thousands of Americans who are working on your behalf (but NOT as employees), and this number is expected to grow to 40% of the workforce by 2018.

Over the last few months we’ve talked to a couple hundred folks working in the collaborative economy as independent contractors. We’ve asked lots of questions like:

“Have you ever received a 1099 before?”

“How much planning have you done for taxes?”

“Nope.” “None.” has been the overwhelming response.

One ramification of the rise of the sharing and on-demand economies is how many people will be receiving IRS form 1099 for the first time this month. And most have no clue what to do about taxes.

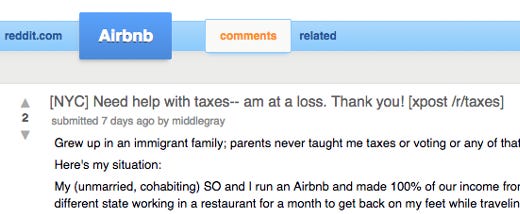

The AirBnB subreddit

Financial literacy around what being an independent contractor means is a major hurdle for lots of folks in the on-demand & sharing economies. It’s our mission to help the people powering these platforms to benefit from them as much as the consumers and companies.

Since so many people are getting 1099’s for the first time this year, how about we get together to give them a hand on what its going to mean for them?

What taxes mean for independent contractors

By February 17, you will send 1099’s to your independent contractors and to the IRS reporting the income they were paid during 2014 if it was in excess of $600.

And here are some of the things we’ve been hearing from people in all those conversations we’ve been having.

I’m not going to report that income anyway, the IRS doesn’t know.

If you’ve received a 1099, the IRS did too.

The company I work for has been withholding taxes for me, right?

Nope. Unless you paid them yourself, no taxes have been paid on this money yet. Your income will be subject to self-employment taxes and income tax.

I’m taxed on the total income on reported on my 1099 form?

Not necessarily. Did you incur expenses while performing the work? Those are deductible and you should deduct them on your schedule C where you report your self-employment income. These expenses can include gas, mileage, tools you needed for work.

Should I be saving money to pay for taxes?

Put away enough money to cover your income taxes (depends on your tax bracket) plus 15.3% to cover self-employment tax. This could mean you need to be saving 40% or more of your income to cover taxes… yeah, we agree, its a lot!

Should I be paying quarterly taxes?

Probably, yes.

This is going to be a learning year for many people who are receiving a 1099 for the first time, if you haven’t been putting some money away for taxes or saving receipts for your expenses , unfortunately, you’re in a bit of a pickle.

We need to help the workers powering the collaborative economy to think of themselves as entrepreneurs, not employees. Because you are working as an independent contractor, you are in fact running the business called you and need to think about how you’re accounting for things.

OK, so we agree there are a bunch of drivers, hosts, messengers and home cleaners who are ill-prepared for tax season, we should do something to help them, right?

Not so fast…

Companies are limited by independent contractor classification

Collaborative economy companies must be careful to maintain independent contractor status and mitigate misclassification risk. You’ve chosen to classify the people powering their services as independent contractors, which means you must pass the 20-point checklist for correct classification of their workforce.

Point #6 is:

“Training. Do you train the worker to do the job in a particular way? (Independent contractors are already trained.)”

Which means in order to mitigate misclassification risk, companies must limit what training and education they can provide to the independent contractors, resulting in most companies simply referring people to tax professionals.

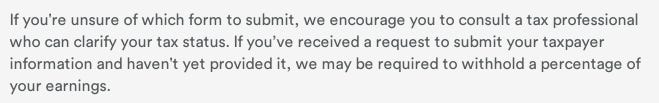

In addition, your lawyers probably have steered you away from giving any tax guidance, which is why the only information people can find on your websites are are things like this:

Airbnb — How do taxes work for hosts?

Lyft — Tax information

Helpful, right?

So, the paradox is that because of the risk of having their workforce reclassified as employees, companies cannot provide training to their workforce on how to handle taxes as an independent contractor — leaving a void.

We can help.

The original meaning of kung fu is to ‘acquire skill through hard work and practice’ — Our mission at KungFu is to help both the company and individual in this new economy win.

There’s a lot we plan to do, but to start, we’ll be publishing tax guides highlighting potential write-offs targeted at different segments over the next month. Feel free to point people to us.

Let’s all do the best we can to help all those people receiving a 1099 for the first time understand what it means for tax season this year. After all, we want to make sure they succeed in the marketplaces and platforms so everyone can continue to grow.

Of course another reason these companies shy away from giving tax guidance is the associated risk. Specific advice for individuals is best left to a licensed CPA, which is why everyone recommends consulting a tax professional. We do the same thing. We recommend you consult one too for specific tax questions.

Thanks to our CPA friends Brad Ebenhoeh and Siroos Teherani for reviewing drafts of this post.

Feedback? Hit us up @kungfu